Neil Wright is a bank operations executive with 25 years' experience in capital markets' operations and audit and control. Neil is currently head of the Derivative Product and Strategy Group at State Street Corporation. He commenced his career at Chase Manhattan Bank as an internal auditor after receiving a Bachelor of Science degree in finance from Fairfield University. From auditing, he moved to manage Chase's Internal Control Group for all operations in Europe and then became the global head of derivative operations. In this role, Neil consolidated all operations into one processing centre of excellence and managed the consolidations of the derivative processing groups during two major mergers (Chase/Chemical and Chase/JPMorgan). He has been active in all industry groups relating to derivative operations, including acting as chairman of the International Swaps and Derivative Association (ISDA) North American Operations Committee, as board member of FpML.org and as founding member of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) Derivative User Committee. After his time at JPMorgan Chase, Neil joined Citigroup as global head of commodity operations while also running the Derivative Collateral Management Group.

ABSTRACT

Over-the-counter (OTC) derivatives have become a dominant force in the international securities market. Today, derivatives are considered to be a strategy of choice among institutional investors who increasingly value derivatives' versatility in meeting a broad range of needs and objectives. As a result of this expanding universe of investors, the volume of derivatives traded has risen steeply.

This growth has brought with it new and urgent challenges that, if not addressed, threaten to cast a shadow across this critically important market. In an effort to meet these challenges, regulators and industry associations have formed working groups to identify ways in which to improve derivatives processing and enhance the efficiency of the market. The result is a series of steps that move in that direction, including cross-industry utilities to assist in introducing greater levels of reliability in processing and information.

Yet, as new investors enter the market, they - and their asset managers - are encountering unique challenges in servicing derivatives-based investment strategies. The derivatives and asset servicing industries' ability to devise manageable solutions for these challenges will determine their success. New servicing solutions will also help shape the market itself, since growth in the derivatives market drives growth in the servicing industry.

The time is right for taking a new approach to servicing OTC derivatives. Best practices will take into account what best serves mainstream investors and asset managers, addressing pain points and reducing operational risks. While the particular solutions that deliver these results may differ, successful solutions will adhere to four overall standards of customer service: reliability, flexibility, transparency and trained expertise.

Keywords: over-the-counter (OTC) derivatives; outsourcing; asset managers; investors

INTRODUCTION

With derivatives becoming an increasingly important component in today's investment strategies, their growth has surpassed other sectors of the international securities market. This expansion is evident in the sheer number of derivatives and participants in the marketplace, including investors, traders and asset managers. Yet, despite this surge, the derivatives market still lacks the infrastructure to support what has been a largely manual environment. As a result, scrutiny from regulators in all jurisdictions has increased.

Evolving utilities and services are rising to assist in developing the necessary infrastructure to support the trading of these instruments and collectively represent a light at the end of the derivatives processing tunnel. But, as the backlogs of unsettled and unconfirmed derivatives trades demonstrate, challenges remain. These challenges point the way towards an enhanced role for asset servicers and custodians in supporting their clients' derivative instruments trading.

GROWTH OF THE OTC DERIVATIVES MARKET

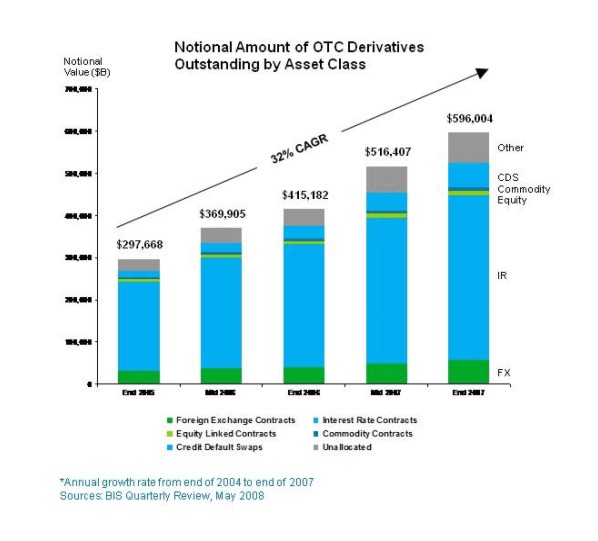

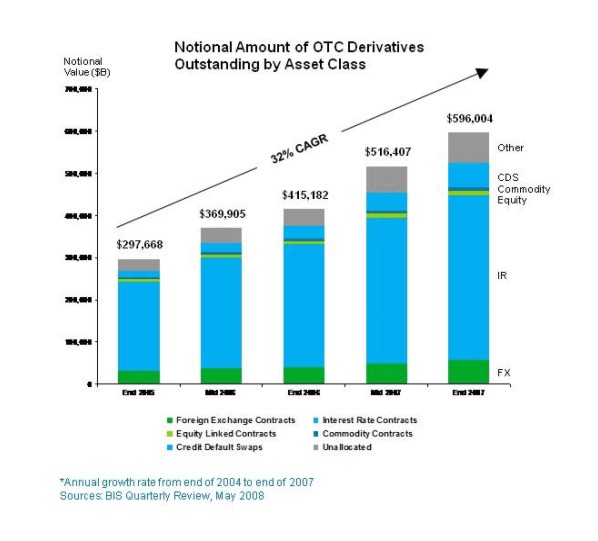

Over-the-counter (OTC) derivatives represent the highest growth area in the international capital markets. The notional amount of outstanding OTC derivatives contracts reached US$516tn at the end of June 2007.1 This is a substantial amount that dwarfs the global equity markets, which are currently valued at a little over US$50tn (see Figure 1).

Figure 1 Growth of the OTC derivative market

In fact, the growth rate of the derivatives market has nearly doubled that of the global equity markets. From the end of 2004 through 2006, the global stock markets grew at an annualised rate of 14 per cent. By contrast, the OTC segment of the derivatives market experienced 27 per cent annual growth rates since the end of 1999.2 In the six months ending June 2007, positions in OTC derivatives increased by 135 per cent, representing a compound annualised growth rate of 33 per cent.3 Interest rate derivatives and credit default swaps have driven much of the overall growth of this market segment: the former grew by 38 per cent during 2006 and the latter by 107 per cent.

Yet volume growth tells only part of the story about where the OTC derivatives market is headed. Growth in terms of rising institutional investment in these instruments far outpaces these figures. Industry experts not only foresee the overall volume of derivatives transactions continuing to grow, but they also anticipate a significant expansion in the type and complexity of products offered in the sector.

The market's increasing appetite for derivatives stems from a variety of factors, including investors' desires for higher absolute returns, access to more efficient vehicles for meeting certain hedging requirements and for broader diversification. Derivatives represent a very efficient way for asset managers to take positions in both the equity and fixed-income markets to enhance returns.

In addition to enabling short positions in the market, derivatives are useful for providing a hedge against risk by gaining exposure to foreign markets, for example, and for managing interest rate and credit risk. The area of the market that has experienced the greatest growth is credit default swaps, where investors can use derivatives to hedge the speculative nature of certain bonds. These instruments have been making headlines lately, along with their cousins, credit default obligations (CDOs). With liquidity drying up as a result of sub-prime mortgage issues, investors became unsure of the valuation of some of these instruments, which has led to write-downs and rampant selling. As we will discuss later, valuation is certainly a key challenge - and risk - for derivatives investors.

Derivatives are also a tool used in liability-driven investing (LDI), an approach for pension plans that seeks to match future cash payments to pensioners. To match liabilities in such a framework, pension managers often seek to protect future cash payouts from interest rate risk by investing in interest rate swaps that match the future liability dates of their plans. As a result, the increasing use of LDI strategies has become a contributing factor to growth in the derivatives marketplace.

Along with a shifting institutional appetite for risk, changing regulatory requirements have also played a role in the increasing demand for these instruments. For example, the European Union's Undertakings for Collective Investment in Transferable Securities (UCITS) III regulatory framework now permits asset managers greater flexibility in the types of financial instruments that they can use in fund portfolios.

As demand for these instruments continues to rise, the growth in derivative-based products and transactions creates new challenges for the systems needed to process and manage them.

A DIFFICULT DECISION

For many, the difficulty begins with the decision to invest in derivatives. Asset managers and institutional investors have enormous pent-up demand for these instruments, but many are struggling with legacy applications and a knowledge base that is oriented toward traditional securities processing.

In some cases, despite a desire to begin supporting trading in derivatives, there is a lack of wherewithal to build new systems for processing derivatives or to implement work-around solutions. This can delay the use of desired investment strategies or the introduction of new products to market that incorporate derivatives - such as the increasingly popular 130/30 or long/short funds, which can use synthetic swaps for shorting positions.

Yet institutional investors may also conclude they do not have a choice. To meet investment strategies, credit or interest rate swaps are fast becoming mainstream fare in these investors' portfolios.

MARKET STANDARDISATION - A REACTION TO GROWTH

The challenges facing the industry as it races to catch up with the enormous growth of derivatives have not gone unnoticed by financial services regulators around the globe. In the USA, Timothy Geithner, the president of the Federal Reserve Bank of New York (FRBNY), was among the first to raise publicly concerns about the lack of infrastructure supporting the OTC derivatives market in a speech delivered at the SWIFT International Banking Operations Seminar (SIBOS) in 2004.

The following year, the FRBNY organised a meeting during which the largest industry participants - the dealers -committed to addressing the backlogs of unconfirmed and unsettled trades. They agreed to reduce the time needed to confirm transactions by working to match trades electronically rather than manually. As a result of these discussions and the services that have evolved over the past few years, such as the Depository Trust and Clearing Corporation (DTCC) Deriv/SERV and SwapsWire, today, OTC derivatives-related processing and infrastructure issues are being addressed with market standardisation.

Several key industry-wide standards for communicating derivatives trades predated these services. One example is the International Swaps and Derivatives Association (ISDA) Financial products Markup Language (FpML) standard, which continues to evolve as more market participants use and deploy systems that incorporate this electronic protocol for representing and communicating derivative trades. ISDA also introduced the Novation Protocol to standardise the way in which transactions are assigned from one party to another, to ensure that all three parties are aware of and agree to the assignment.

In many regions, regulators have begun mandating that derivatives transactions over a certain volume between two parties be matched electronically. At the same time, industry-wide automated electronic trade matching solutions have also emerged. Among these, the DTCC Deriv/SERV provides trade matching and confirmation services for the OTC derivatives market along with the DTCC Trade Information Warehouse to automate post-trade processing. SwapsWire offers a similar service in providing an electronic solution to confirming OTC derivatives. Finally, the SWIFT network has supplied a solution to lessen the manual processing burden of derivatives trades by providing the ability to communicate the advice notices sent to custodians for new derivatives transactions and their associated settlements in an FpML format, using what is termed 'SWIFTWrapper'. Many of these utilities have begun expanding services to include a broader range of derivatives trades.

Yet despite the evolvement of such industry-wide utilities, the processing challenges inherent in the burgeoning growth of the derivatives market remain staggering -particularly from an operational point of view.

The latest commitments from the major market participants, in the form of a letter to the FRBNY dated 27th March, 2008, reflects increased collaboration between the dealer community, institutional investors and the industry associations - ISDA, the Securities Industry and Financial Markets Association (SIFMA) and the Managed Funds Association (MFA) - to continue to set operational goals to improve the industry. The focus continues on credit and equity derivatives, with an emphasis on increasing the automation of the confirmation and settlement processes.

CHALLENGES IN MIDDLE AND BACK-OFFICE FUNCTIONS

Derivatives transactions differ significantly from standard vanilla equity trades. For example, the number of terms that accompany each type of trade presents a stark contrast: for a derivatives transaction, there may be up to a hundred fields that encompass the details of a single trade; for the standard equity stock trade, there may be only five or six. Any degree of trade customisation further complicates trade management functions. Without automation, delays in a trade's confirmation and settlement differences can easily result.

A derivatives transaction has an average lifespan of four to five years and settlements occur at varying degrees of frequency to accommodate the fixing of floating-rate interest rates, for example. Servicers of derivatives must reference contract terms to determine these periodic cash flow settlements. As a result, there are many opportunities for errors and even failure of periodic settlements, which can result from calculation differences between counterparties, based on differing reference data.

There is also significant risk for both the seller and buyer attached to the accurate valuation of derivatives. Derivatives servicers value derivatives using highly sophisticated mathematical models and valuations can vary depending on the data used or the mathematical model assumptions. This creates a need for verification from a second source. At any point in the valuation chain, then, the risk of a variance in valuation may arise. At the same time, regulators in many jurisdictions require the use of an independent outside party to value derivatives. Using multiple valuation sources can help to mitigate valuation risk.

Collateral is also an integral part of the valuation process for derivatives. In the event that the value of a derivatives portfolio goes below the value specified in the applicable credit support annex (CSA), the counterparty is required to post collateral as outlined in the CSA. As a result, in addition to monitoring the terms of a derivatives trade and valuation, the associated collateral requirements of the trade must be actively managed to ensure compliance with the terms of the applicable CSA.

From trade management to valuation to periodic settlement, the challenges in supporting derivative processing are immense. The risk of error is high, particularly given the highly manual and specialised nature of many processing systems.

A HIGH INCIDENCE OF OPERATIONAL INEFFICIENCIES

Once investors decide to add derivatives to their investment programme, those with standard technology platforms built to support more traditional investment products such as equity and fixed-income transactions face a new challenge. These legacy systems are now tasked, both at the front and back ends, with processing vastly more complex transactions for which they were not specifically designed - and at a rapidly growing volume.

The result is often to resort to manual accounting and spreadsheet-based tracking to account for and process OTC derivatives. This incurs increased operational costs and added efforts - and manpower - to complete what some may view as routine tasks. In addition, these manual processes introduce operational risk through high error rates. This risk can introduce serious consequences, such as increased risk of loss due to counterparty errors and decreased returns as a result of decisions made based on incorrect positions or valuation information.

Even with the development of industry-wide utilities and systems designed to alleviate some of the manual processing of OTC derivatives, such as the DTCC's Trade Information Warehouse, there remain significant backlogs of trade settlements that have not yet been cleared. These issues are taxing asset managers from a cash standpoint. At present, the dealers are working to match all trades with the goal of achieving one net settlement daily per currency, per counterparty via the functionality provided by the Warehouse. To date, approximately 1.5 million positions have been back-loaded into the Warehouse. This is largely dealer-to-dealer activity and, during 2008, the DTCC is going to focus on getting the buy-side firms to backload their trades.

In light of this environment, asset managers are seeing the value of fully integrated investment servicing solutions, outsourcing middle and back-office functions as a strategy to manage the growing flood of derivatives transactions, and to give them access to the utilities and services that are increasingly becoming available and a requirement to trade in the OTC market.

THE CASE FOR OPTIMISING RESOURCES THROUGH OUTSOURCING

With the derivatives market quickly eclipsing the traditional markets in size, attention has been drawn as never before to the specialised resources that today's strategically positioned asset servicing firms offer. The need to outsource middle and back-office functions has assumed new urgency.

For asset managers, a growing desire to invest in derivatives argues strongly in favour of investing internal resources in the front office, while outsourcing to a third party the processing and monitoring tasks that would otherwise require a significant outlay of cash for underlying technology and expert staff. By automating derivative processing and associated monitoring and building linkages to the array of utilities and services that have recently evolved, an experienced service provider can help asset managers support the growing volume of trading these instruments.

Key to understanding and evaluating outsourcing capabilities for derivatives transactions are the critical systems, technology and expertise needed to support them.

IDENTIFYING BEST PRACTICES - A HOLISTIC APPROACH

For custodians and asset servicers alike, the emergence of best practices represents a giant leap forward in addressing challenges that, if unanswered, could significantly affect investor confidence. This is particularly important, given the growing presence of new investor classes that will seek optimal solutions and results.

Suggestions abound in the industry regarding which practices ought to prevail. The true test of which ones deserve widespread adoption will ultimately lie in the results achieved and the benefits offered. In the meantime, however, it may help to think holistically about how to raise the bar for customer service when it comes to servicing OTC derivatives.

A holistic approach takes into account four overall standards of customer service: systems reliability, flexibility, transparency and trained expertise. Taken together, these four standards define what asset servicers must offer to enhance significantly the support they provide for their clients' derivatives investment strategies.

Systems reliability

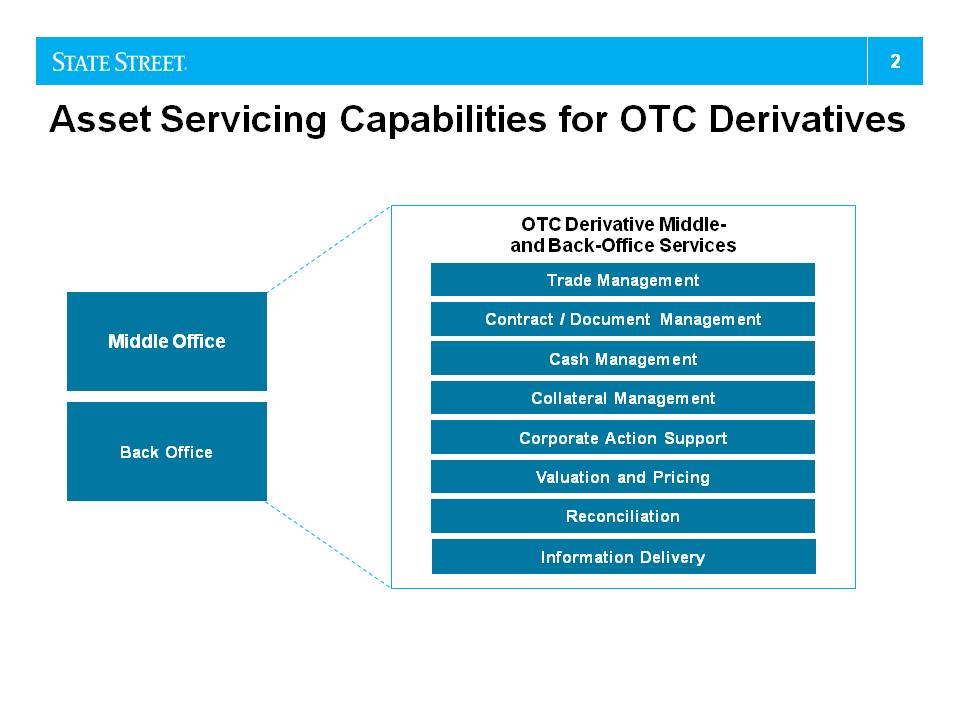

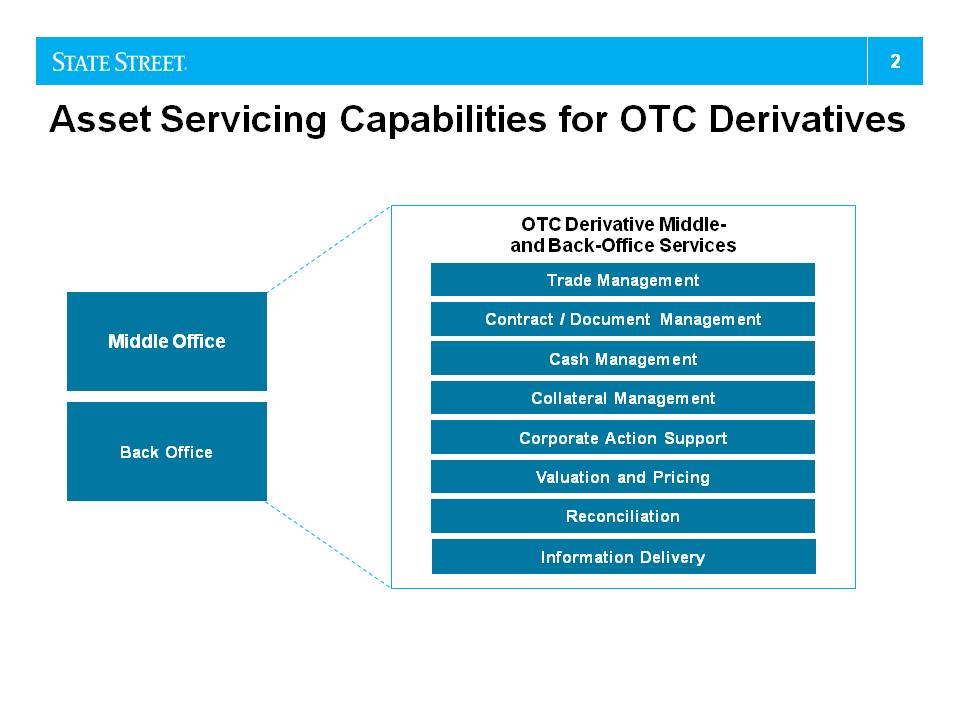

Systems reliability aims for error reduction through automation, fast error correction and robust architecture. Reliability is the cornerstone of confidence and, as such, must apply across the full spectrum of middle and back-office functions that define the servicing phase of derivatives (see Figure 2).

Figure 2 Core OTC derivative services

Robust platforms to process and manage the sophisticated details of OTC trades offer an effective road map for achieving it. Advanced technology holds the key to developing scaleable and robust platforms that can accommodate the wide range of derivatives trades that the market sees today. Such platforms must also have the flexibility and capacity to match the needs of the foreseeable future.

In addition, these platforms must be capable of performing an array of functions, such as sophisticated valuation methods, the periodic resets that are typical of derivatives trades, precise and accurate settlement requirements and carefully executed collateral management arrangements.

Performance characteristics of an ideal platform may include:

- scaleability, to accommodate current volumes and allow for further growth;

- high performance that emphasises short response times;

- error tolerance, to work through invalid or conflicting data;

- the capability to link up with market utilities.

In addition to offering a wide range of choices reflective of today's dynamic OTC derivatives market, the best solutions must also be adaptable to new possibilities. Customisation is one example of flexibility. Because post-trade servicing is a matter of many interdependent operations, the ability to select either a full suite of services or individually from a comprehensive menu is advantageous.

This allows a client to retain in-house control of certain functions while outsourcing others, for example. Thus, clients retain the freedom to develop and focus selectively on their own needs and capabilities for the future. And by inviting them to evaluate and compare external resources critically, it enhances confidence in the market.

Adaptation to change is another aspect of flexibility. Over time, product innovation brings about new demands. Future regulatory requirements could significantly affect servicing arrangements, such as data reporting, document access, confirmations or information exchange. Best-practice thinking anticipates change by building in the flexibility that can accommodate it.

Transparency

In the case of OTC derivatives servicing, 'transparency' refers to any practice that may enhance a clear understanding of the process. One example is standardisation, including the use of such standard formats as the ISDA master agreement and FpML Improved pricing and valuation are also examples.

Industry opinion is realising the benefit of drawing valuations from multiple sources. Moreover, industry trade associations have begun to call for independent valuations as a standard procedure. As a result, custodians are more frequently turning to multiple sources for valuations, in particular to third-party vendors who specialise in the arcane calculation of valuations. A few firms have even developed proprietary models, which are then compared with data from independent sources.

While it remains unclear to what extent industry standardisation will ever extend to the valuation process for derivatives, moving valuation as a function onto an intelligent platform, with comparative valuations from several independent sources, will likely bring greater transparency to the derivatives market.

Expertise

Rapid changes in the derivatives market - regulatory, product-driven and technological - call for specialised knowledge that looks ahead to the future and anticipates client pain points. While technology and advanced processing systems - reflecting emerging best practices - will matter enormously, most valued will be trained and expert staff who can navigate through the tough issues that these derivatives trades present.

Specialised staff assigned to middle and back-office clients should understand the entire spectrum of derivatives processing. In addition, product specialists can assist with the unique features that particular transactions present. Staff expertise and talent is most capable of bringing reliability, flexibility and transparency to reality by viewing derivatives servicing in the holistic fashion that today's challenges require.

CONCLUSION

As the proliferation of derivatives shifts into high gear, the case for optimising resources through outsourcing has gained importance. Despite the evolution of industry-wide utilities and systems designed to provide an essential infrastructure for the trading of derivatives, more work remains. The industry continues to struggle with legacy systems and manual processes for the servicing of OTC derivatives. As innovation continues in this new and fast-growing segment of the securities market, institutional investors and their service providers must bring systems up to speed to handle more complex trades at a higher volume than ever before. By outsourcing to a service provider with experience in derivatives processing and a deep knowledge of existing utilities, asset managers can work within the existing network of utilities and systems to put past trades on the books and to broker new trades more efficiently and with lower risk of failure. In turn, outsourcing leadership can rise to meet the challenges of servicing OTC derivatives and turn those challenges into an opportunity for greater growth for asset managers and the industry as a whole.

REFERENCES

(1) Bank for International Settlements (2007) Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity in 2007, 19th December, available online at http://www.bis.org/triennial.htm.

(2) See n. 1.

(3) See n. 1.

This site, like many others, uses small files called cookies to customize your experience. Cookies appear to be blocked on this browser. Please consider allowing cookies so that you can enjoy more content across assetman.net.

How do I enable cookies in my browser?

Internet Explorer

1. Click the Tools button (or press ALT and T on the keyboard), and then click Internet Options.

2. Click the Privacy tab

3. Move the slider away from 'Block all cookies' to a setting you're comfortable with.

Firefox

1. At the top of the Firefox window, click on the Tools menu and select Options...

2. Select the Privacy panel.

3. Set Firefox will: to Use custom settings for history.

4. Make sure Accept cookies from sites is selected.

Safari Browser

1. Click Safari icon in Menu Bar

2. Click Preferences (gear icon)

3. Click Security icon

4. Accept cookies: select Radio button "only from sites I visit"

Chrome

1. Click the menu icon to the right of the address bar (looks like 3 lines)

2. Click Settings

3. Click the "Show advanced settings" tab at the bottom

4. Click the "Content settings..." button in the Privacy section

5. At the top under Cookies make sure it is set to "Allow local data to be set (recommended)"

Opera

1. Click the red O button in the upper left hand corner

2. Select Settings -> Preferences

3. Select the Advanced Tab

4. Select Cookies in the list on the left side

5. Set it to "Accept cookies" or "Accept cookies only from the sites I visit"

6. Click OK

Neil Wright is a bank operations executive with 25 years' experience in capital markets' operations and audit and control. Neil is currently head of the Derivative Product and Strategy Group at State Street Corporation. He commenced his career at Chase Manhattan Bank as an internal auditor after receiving a Bachelor of Science degree in finance from Fairfield University. From auditing, he moved to manage Chase's Internal Control Group for all operations in Europe and then became the global head of derivative operations. In this role, Neil consolidated all operations into one processing centre of excellence and managed the consolidations of the derivative processing groups during two major mergers (Chase/Chemical and Chase/JPMorgan). He has been active in all industry groups relating to derivative operations, including acting as chairman of the International Swaps and Derivative Association (ISDA) North American Operations Committee, as board member of FpML.org and as founding member of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) Derivative User Committee. After his time at JPMorgan Chase, Neil joined Citigroup as global head of commodity operations while also running the Derivative Collateral Management Group.

ABSTRACT

Over-the-counter (OTC) derivatives have become a dominant force in the international securities market. Today, derivatives are considered to be a strategy of choice among institutional investors who increasingly value derivatives' versatility in meeting a broad range of needs and objectives. As a result of this expanding universe of investors, the volume of derivatives traded has risen steeply.

This growth has brought with it new and urgent challenges that, if not addressed, threaten to cast a shadow across this critically important market. In an effort to meet these challenges, regulators and industry associations have formed working groups to identify ways in which to improve derivatives processing and enhance the efficiency of the market. The result is a series of steps that move in that direction, including cross-industry utilities to assist in introducing greater levels of reliability in processing and information.

Yet, as new investors enter the market, they - and their asset managers - are encountering unique challenges in servicing derivatives-based investment strategies. The derivatives and asset servicing industries' ability to devise manageable solutions for these challenges will determine their success. New servicing solutions will also help shape the market itself, since growth in the derivatives market drives growth in the servicing industry.

The time is right for taking a new approach to servicing OTC derivatives. Best practices will take into account what best serves mainstream investors and asset managers, addressing pain points and reducing operational risks. While the particular solutions that deliver these results may differ, successful solutions will adhere to four overall standards of customer service: reliability, flexibility, transparency and trained expertise.

Keywords: over-the-counter (OTC) derivatives; outsourcing; asset managers; investors

INTRODUCTION

With derivatives becoming an increasingly important component in today's investment strategies, their growth has surpassed other sectors of the international securities market. This expansion is evident in the sheer number of derivatives and participants in the marketplace, including investors, traders and asset managers. Yet, despite this surge, the derivatives market still lacks the infrastructure to support what has been a largely manual environment. As a result, scrutiny from regulators in all jurisdictions has increased.

Evolving utilities and services are rising to assist in developing the necessary infrastructure to support the trading of these instruments and collectively represent a light at the end of the derivatives processing tunnel. But, as the backlogs of unsettled and unconfirmed derivatives trades demonstrate, challenges remain. These challenges point the way towards an enhanced role for asset servicers and custodians in supporting their clients' derivative instruments trading.

GROWTH OF THE OTC DERIVATIVES MARKET

Over-the-counter (OTC) derivatives represent the highest growth area in the international capital markets. The notional amount of outstanding OTC derivatives contracts reached US$516tn at the end of June 2007.1 This is a substantial amount that dwarfs the global equity markets, which are currently valued at a little over US$50tn (see Figure 1).

Figure 1 Growth of the OTC derivative market

In fact, the growth rate of the derivatives market has nearly doubled that of the global equity markets. From the end of 2004 through 2006, the global stock markets grew at an annualised rate of 14 per cent. By contrast, the OTC segment of the derivatives market experienced 27 per cent annual growth rates since the end of 1999.2 In the six months ending June 2007, positions in OTC derivatives increased by 135 per cent, representing a compound annualised growth rate of 33 per cent.3 Interest rate derivatives and credit default swaps have driven much of the overall growth of this market segment: the former grew by 38 per cent during 2006 and the latter by 107 per cent.

Yet volume growth tells only part of the story about where the OTC derivatives market is headed. Growth in terms of rising institutional investment in these instruments far outpaces these figures. Industry experts not only foresee the overall volume of derivatives transactions continuing to grow, but they also anticipate a significant expansion in the type and complexity of products offered in the sector.

The market's increasing appetite for derivatives stems from a variety of factors, including investors' desires for higher absolute returns, access to more efficient vehicles for meeting certain hedging requirements and for broader diversification. Derivatives represent a very efficient way for asset managers to take positions in both the equity and fixed-income markets to enhance returns.

In addition to enabling short positions in the market, derivatives are useful for providing a hedge against risk by gaining exposure to foreign markets, for example, and for managing interest rate and credit risk. The area of the market that has experienced the greatest growth is credit default swaps, where investors can use derivatives to hedge the speculative nature of certain bonds. These instruments have been making headlines lately, along with their cousins, credit default obligations (CDOs). With liquidity drying up as a result of sub-prime mortgage issues, investors became unsure of the valuation of some of these instruments, which has led to write-downs and rampant selling. As we will discuss later, valuation is certainly a key challenge - and risk - for derivatives investors.

Derivatives are also a tool used in liability-driven investing (LDI), an approach for pension plans that seeks to match future cash payments to pensioners. To match liabilities in such a framework, pension managers often seek to protect future cash payouts from interest rate risk by investing in interest rate swaps that match the future liability dates of their plans. As a result, the increasing use of LDI strategies has become a contributing factor to growth in the derivatives marketplace.

Along with a shifting institutional appetite for risk, changing regulatory requirements have also played a role in the increasing demand for these instruments. For example, the European Union's Undertakings for Collective Investment in Transferable Securities (UCITS) III regulatory framework now permits asset managers greater flexibility in the types of financial instruments that they can use in fund portfolios.

As demand for these instruments continues to rise, the growth in derivative-based products and transactions creates new challenges for the systems needed to process and manage them.

A DIFFICULT DECISION

For many, the difficulty begins with the decision to invest in derivatives. Asset managers and institutional investors have enormous pent-up demand for these instruments, but many are struggling with legacy applications and a knowledge base that is oriented toward traditional securities processing.

In some cases, despite a desire to begin supporting trading in derivatives, there is a lack of wherewithal to build new systems for processing derivatives or to implement work-around solutions. This can delay the use of desired investment strategies or the introduction of new products to market that incorporate derivatives - such as the increasingly popular 130/30 or long/short funds, which can use synthetic swaps for shorting positions.

Yet institutional investors may also conclude they do not have a choice. To meet investment strategies, credit or interest rate swaps are fast becoming mainstream fare in these investors' portfolios.

MARKET STANDARDISATION - A REACTION TO GROWTH

The challenges facing the industry as it races to catch up with the enormous growth of derivatives have not gone unnoticed by financial services regulators around the globe. In the USA, Timothy Geithner, the president of the Federal Reserve Bank of New York (FRBNY), was among the first to raise publicly concerns about the lack of infrastructure supporting the OTC derivatives market in a speech delivered at the SWIFT International Banking Operations Seminar (SIBOS) in 2004.

The following year, the FRBNY organised a meeting during which the largest industry participants - the dealers -committed to addressing the backlogs of unconfirmed and unsettled trades. They agreed to reduce the time needed to confirm transactions by working to match trades electronically rather than manually. As a result of these discussions and the services that have evolved over the past few years, such as the Depository Trust and Clearing Corporation (DTCC) Deriv/SERV and SwapsWire, today, OTC derivatives-related processing and infrastructure issues are being addressed with market standardisation.

Several key industry-wide standards for communicating derivatives trades predated these services. One example is the International Swaps and Derivatives Association (ISDA) Financial products Markup Language (FpML) standard, which continues to evolve as more market participants use and deploy systems that incorporate this electronic protocol for representing and communicating derivative trades. ISDA also introduced the Novation Protocol to standardise the way in which transactions are assigned from one party to another, to ensure that all three parties are aware of and agree to the assignment.

In many regions, regulators have begun mandating that derivatives transactions over a certain volume between two parties be matched electronically. At the same time, industry-wide automated electronic trade matching solutions have also emerged. Among these, the DTCC Deriv/SERV provides trade matching and confirmation services for the OTC derivatives market along with the DTCC Trade Information Warehouse to automate post-trade processing. SwapsWire offers a similar service in providing an electronic solution to confirming OTC derivatives. Finally, the SWIFT network has supplied a solution to lessen the manual processing burden of derivatives trades by providing the ability to communicate the advice notices sent to custodians for new derivatives transactions and their associated settlements in an FpML format, using what is termed 'SWIFTWrapper'. Many of these utilities have begun expanding services to include a broader range of derivatives trades.

Yet despite the evolvement of such industry-wide utilities, the processing challenges inherent in the burgeoning growth of the derivatives market remain staggering -particularly from an operational point of view.

The latest commitments from the major market participants, in the form of a letter to the FRBNY dated 27th March, 2008, reflects increased collaboration between the dealer community, institutional investors and the industry associations - ISDA, the Securities Industry and Financial Markets Association (SIFMA) and the Managed Funds Association (MFA) - to continue to set operational goals to improve the industry. The focus continues on credit and equity derivatives, with an emphasis on increasing the automation of the confirmation and settlement processes.

CHALLENGES IN MIDDLE AND BACK-OFFICE FUNCTIONS

Derivatives transactions differ significantly from standard vanilla equity trades. For example, the number of terms that accompany each type of trade presents a stark contrast: for a derivatives transaction, there may be up to a hundred fields that encompass the details of a single trade; for the standard equity stock trade, there may be only five or six. Any degree of trade customisation further complicates trade management functions. Without automation, delays in a trade's confirmation and settlement differences can easily result.

A derivatives transaction has an average lifespan of four to five years and settlements occur at varying degrees of frequency to accommodate the fixing of floating-rate interest rates, for example. Servicers of derivatives must reference contract terms to determine these periodic cash flow settlements. As a result, there are many opportunities for errors and even failure of periodic settlements, which can result from calculation differences between counterparties, based on differing reference data.

There is also significant risk for both the seller and buyer attached to the accurate valuation of derivatives. Derivatives servicers value derivatives using highly sophisticated mathematical models and valuations can vary depending on the data used or the mathematical model assumptions. This creates a need for verification from a second source. At any point in the valuation chain, then, the risk of a variance in valuation may arise. At the same time, regulators in many jurisdictions require the use of an independent outside party to value derivatives. Using multiple valuation sources can help to mitigate valuation risk.

Collateral is also an integral part of the valuation process for derivatives. In the event that the value of a derivatives portfolio goes below the value specified in the applicable credit support annex (CSA), the counterparty is required to post collateral as outlined in the CSA. As a result, in addition to monitoring the terms of a derivatives trade and valuation, the associated collateral requirements of the trade must be actively managed to ensure compliance with the terms of the applicable CSA.

From trade management to valuation to periodic settlement, the challenges in supporting derivative processing are immense. The risk of error is high, particularly given the highly manual and specialised nature of many processing systems.

A HIGH INCIDENCE OF OPERATIONAL INEFFICIENCIES

Once investors decide to add derivatives to their investment programme, those with standard technology platforms built to support more traditional investment products such as equity and fixed-income transactions face a new challenge. These legacy systems are now tasked, both at the front and back ends, with processing vastly more complex transactions for which they were not specifically designed - and at a rapidly growing volume.

The result is often to resort to manual accounting and spreadsheet-based tracking to account for and process OTC derivatives. This incurs increased operational costs and added efforts - and manpower - to complete what some may view as routine tasks. In addition, these manual processes introduce operational risk through high error rates. This risk can introduce serious consequences, such as increased risk of loss due to counterparty errors and decreased returns as a result of decisions made based on incorrect positions or valuation information.

Even with the development of industry-wide utilities and systems designed to alleviate some of the manual processing of OTC derivatives, such as the DTCC's Trade Information Warehouse, there remain significant backlogs of trade settlements that have not yet been cleared. These issues are taxing asset managers from a cash standpoint. At present, the dealers are working to match all trades with the goal of achieving one net settlement daily per currency, per counterparty via the functionality provided by the Warehouse. To date, approximately 1.5 million positions have been back-loaded into the Warehouse. This is largely dealer-to-dealer activity and, during 2008, the DTCC is going to focus on getting the buy-side firms to backload their trades.

In light of this environment, asset managers are seeing the value of fully integrated investment servicing solutions, outsourcing middle and back-office functions as a strategy to manage the growing flood of derivatives transactions, and to give them access to the utilities and services that are increasingly becoming available and a requirement to trade in the OTC market.

THE CASE FOR OPTIMISING RESOURCES THROUGH OUTSOURCING

With the derivatives market quickly eclipsing the traditional markets in size, attention has been drawn as never before to the specialised resources that today's strategically positioned asset servicing firms offer. The need to outsource middle and back-office functions has assumed new urgency.

For asset managers, a growing desire to invest in derivatives argues strongly in favour of investing internal resources in the front office, while outsourcing to a third party the processing and monitoring tasks that would otherwise require a significant outlay of cash for underlying technology and expert staff. By automating derivative processing and associated monitoring and building linkages to the array of utilities and services that have recently evolved, an experienced service provider can help asset managers support the growing volume of trading these instruments.

Key to understanding and evaluating outsourcing capabilities for derivatives transactions are the critical systems, technology and expertise needed to support them.

IDENTIFYING BEST PRACTICES - A HOLISTIC APPROACH

For custodians and asset servicers alike, the emergence of best practices represents a giant leap forward in addressing challenges that, if unanswered, could significantly affect investor confidence. This is particularly important, given the growing presence of new investor classes that will seek optimal solutions and results.

Suggestions abound in the industry regarding which practices ought to prevail. The true test of which ones deserve widespread adoption will ultimately lie in the results achieved and the benefits offered. In the meantime, however, it may help to think holistically about how to raise the bar for customer service when it comes to servicing OTC derivatives.

A holistic approach takes into account four overall standards of customer service: systems reliability, flexibility, transparency and trained expertise. Taken together, these four standards define what asset servicers must offer to enhance significantly the support they provide for their clients' derivatives investment strategies.

Systems reliability

Systems reliability aims for error reduction through automation, fast error correction and robust architecture. Reliability is the cornerstone of confidence and, as such, must apply across the full spectrum of middle and back-office functions that define the servicing phase of derivatives (see Figure 2).

Figure 2 Core OTC derivative services

Robust platforms to process and manage the sophisticated details of OTC trades offer an effective road map for achieving it. Advanced technology holds the key to developing scaleable and robust platforms that can accommodate the wide range of derivatives trades that the market sees today. Such platforms must also have the flexibility and capacity to match the needs of the foreseeable future.

In addition, these platforms must be capable of performing an array of functions, such as sophisticated valuation methods, the periodic resets that are typical of derivatives trades, precise and accurate settlement requirements and carefully executed collateral management arrangements.

Performance characteristics of an ideal platform may include:

- scaleability, to accommodate current volumes and allow for further growth;

- high performance that emphasises short response times;

- error tolerance, to work through invalid or conflicting data;

- the capability to link up with market utilities.

In addition to offering a wide range of choices reflective of today's dynamic OTC derivatives market, the best solutions must also be adaptable to new possibilities. Customisation is one example of flexibility. Because post-trade servicing is a matter of many interdependent operations, the ability to select either a full suite of services or individually from a comprehensive menu is advantageous.

This allows a client to retain in-house control of certain functions while outsourcing others, for example. Thus, clients retain the freedom to develop and focus selectively on their own needs and capabilities for the future. And by inviting them to evaluate and compare external resources critically, it enhances confidence in the market.

Adaptation to change is another aspect of flexibility. Over time, product innovation brings about new demands. Future regulatory requirements could significantly affect servicing arrangements, such as data reporting, document access, confirmations or information exchange. Best-practice thinking anticipates change by building in the flexibility that can accommodate it.

Transparency

In the case of OTC derivatives servicing, 'transparency' refers to any practice that may enhance a clear understanding of the process. One example is standardisation, including the use of such standard formats as the ISDA master agreement and FpML Improved pricing and valuation are also examples.

Industry opinion is realising the benefit of drawing valuations from multiple sources. Moreover, industry trade associations have begun to call for independent valuations as a standard procedure. As a result, custodians are more frequently turning to multiple sources for valuations, in particular to third-party vendors who specialise in the arcane calculation of valuations. A few firms have even developed proprietary models, which are then compared with data from independent sources.

While it remains unclear to what extent industry standardisation will ever extend to the valuation process for derivatives, moving valuation as a function onto an intelligent platform, with comparative valuations from several independent sources, will likely bring greater transparency to the derivatives market.

Expertise

Rapid changes in the derivatives market - regulatory, product-driven and technological - call for specialised knowledge that looks ahead to the future and anticipates client pain points. While technology and advanced processing systems - reflecting emerging best practices - will matter enormously, most valued will be trained and expert staff who can navigate through the tough issues that these derivatives trades present.

Specialised staff assigned to middle and back-office clients should understand the entire spectrum of derivatives processing. In addition, product specialists can assist with the unique features that particular transactions present. Staff expertise and talent is most capable of bringing reliability, flexibility and transparency to reality by viewing derivatives servicing in the holistic fashion that today's challenges require.

CONCLUSION

As the proliferation of derivatives shifts into high gear, the case for optimising resources through outsourcing has gained importance. Despite the evolution of industry-wide utilities and systems designed to provide an essential infrastructure for the trading of derivatives, more work remains. The industry continues to struggle with legacy systems and manual processes for the servicing of OTC derivatives. As innovation continues in this new and fast-growing segment of the securities market, institutional investors and their service providers must bring systems up to speed to handle more complex trades at a higher volume than ever before. By outsourcing to a service provider with experience in derivatives processing and a deep knowledge of existing utilities, asset managers can work within the existing network of utilities and systems to put past trades on the books and to broker new trades more efficiently and with lower risk of failure. In turn, outsourcing leadership can rise to meet the challenges of servicing OTC derivatives and turn those challenges into an opportunity for greater growth for asset managers and the industry as a whole.

REFERENCES

(1) Bank for International Settlements (2007) Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity in 2007, 19th December, available online at http://www.bis.org/triennial.htm.

(2) See n. 1.

(3) See n. 1.